Income Tax return or IT Return filing is a headache for all people but it is one of the most necessary action needs to be taken by every working individual. Earlier it had to be filed manually which leaded to piles of paper to income tax department. That was inconvenient for both tax payee and the income tax department, so now anyone can file income tax return through online portals. Besides government portal there are few official non-government portals which made the process very easy.

Read our new blog post on steps to file ITR using the new 2021 portal 2.0

How to File Income Tax Return for salaried individual using the new portal 2.0

Here we are discussing the procedure to file IT Return through Cleartax.

Table of Contents

Steps to file IT Return easily using Cleartax

Step 1

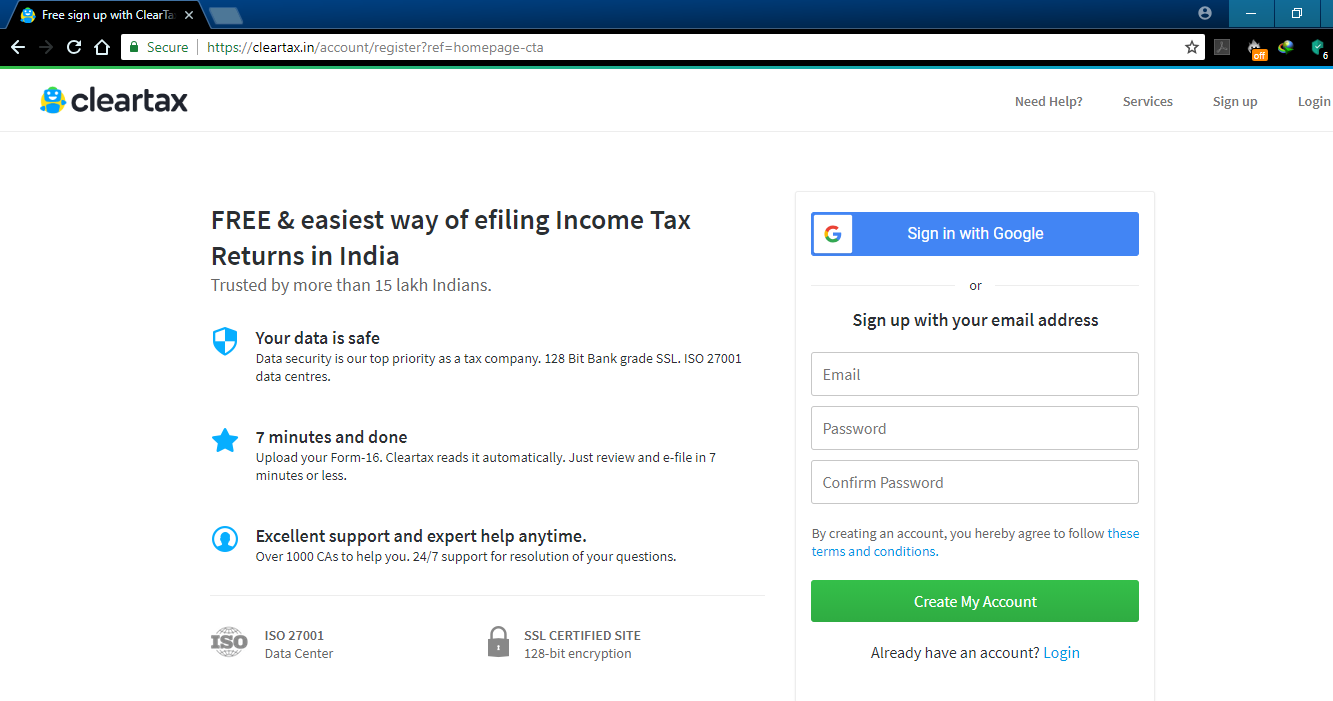

Open Cleartax portal (https://cleartax.in/) in your browser. The site looks something like below.

Step 2

Click the button ‘Start your tax return’.

Step 3

It will take you to the login page. Here you can create new profile or you can login with your username and password, if you are an existing user or you can login through your google account (using gmail id).

Step 4

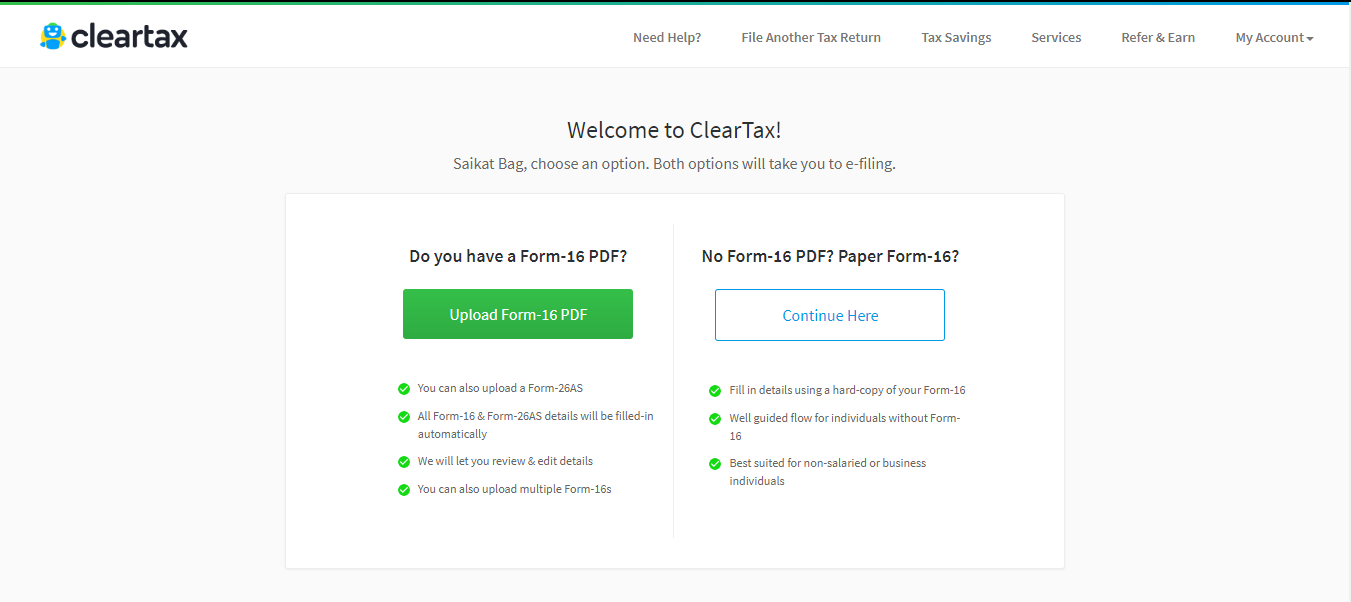

After logging in you will see the option to upload your form16 files by clicking ‘Upload Form-16 PDF’ button. (Only if you have form 16 files in pdf format, else you can manually put the values by selecting ‘Continue here’ button under ‘No Form-16 PDF? Paper Form-16?’ segment)

Step 5

Provide your date of birth and upload the form 16 file provided by your organization.

Step 6

After successful upload of the form 16 file, it will show you the details to validate.

Step 7

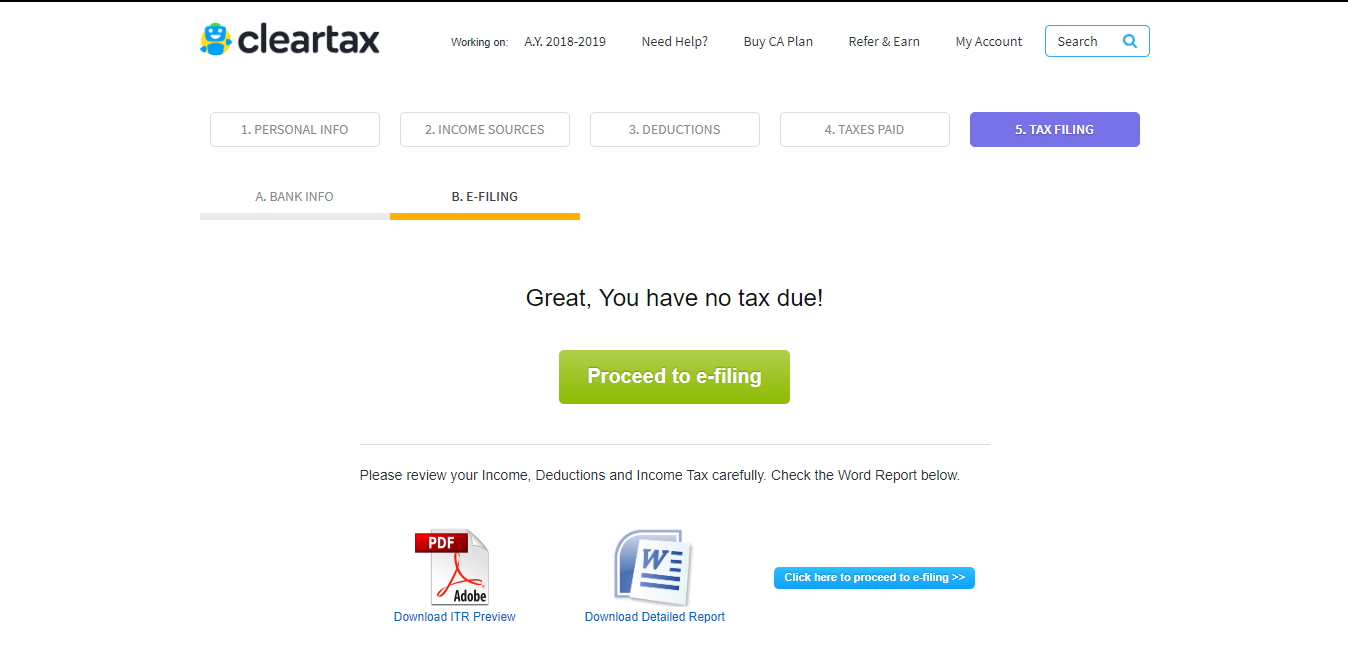

You can upload another form 16 file if needed and then click on ‘Proceed to E filing’

Step 8

Here fill all the details correctly and click on Next. (You can skip the fields those are not applicable for you).

Step 9

Once all the details are provided, click on ‘Proceed to E-filing’.

Step 10

You will be asked to provide an OTP which will be sent to your mobile number which you would provide during efiling in order to proceed to next. Put the OTP in the field and click on Validate OTP. (If you did not recieve any OTP click on Resend OTP, this would help you to receive the OTP.)

Step 11

The digital agreement page will appear. Check the box saying Terms and Conditions and then click on ‘Efile my income tax return’ button to proceed. (It is always recommended to read the terms and conditions once before your e-file the return)

Step 12

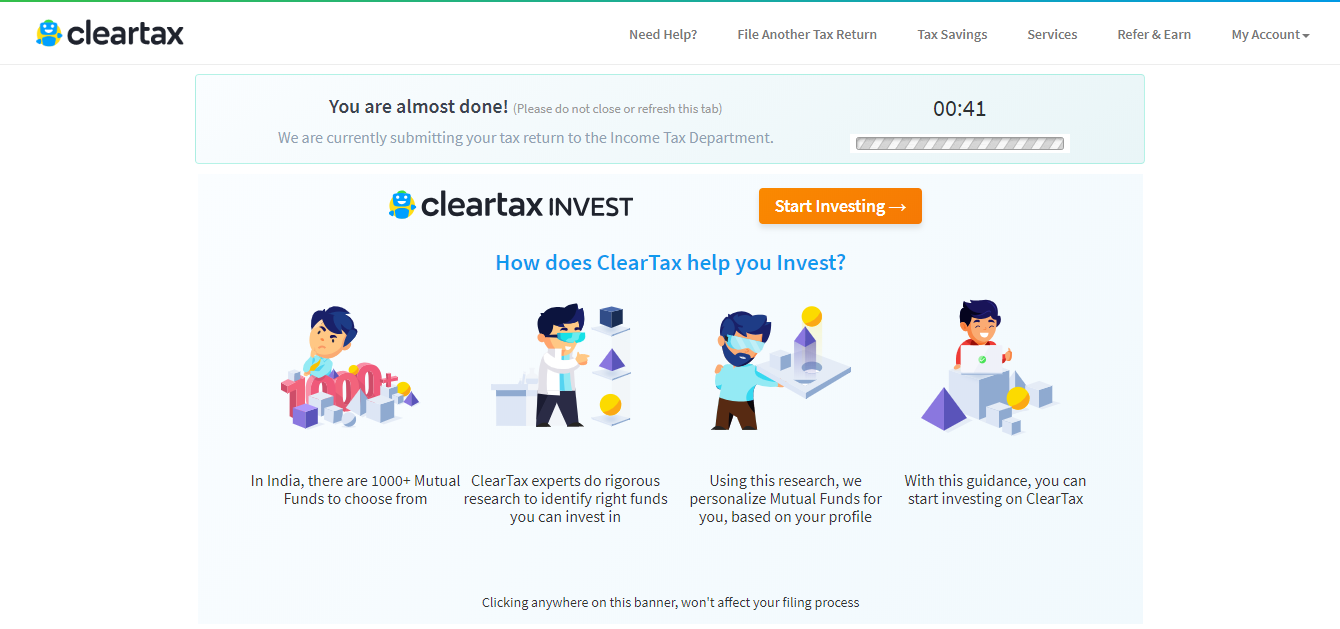

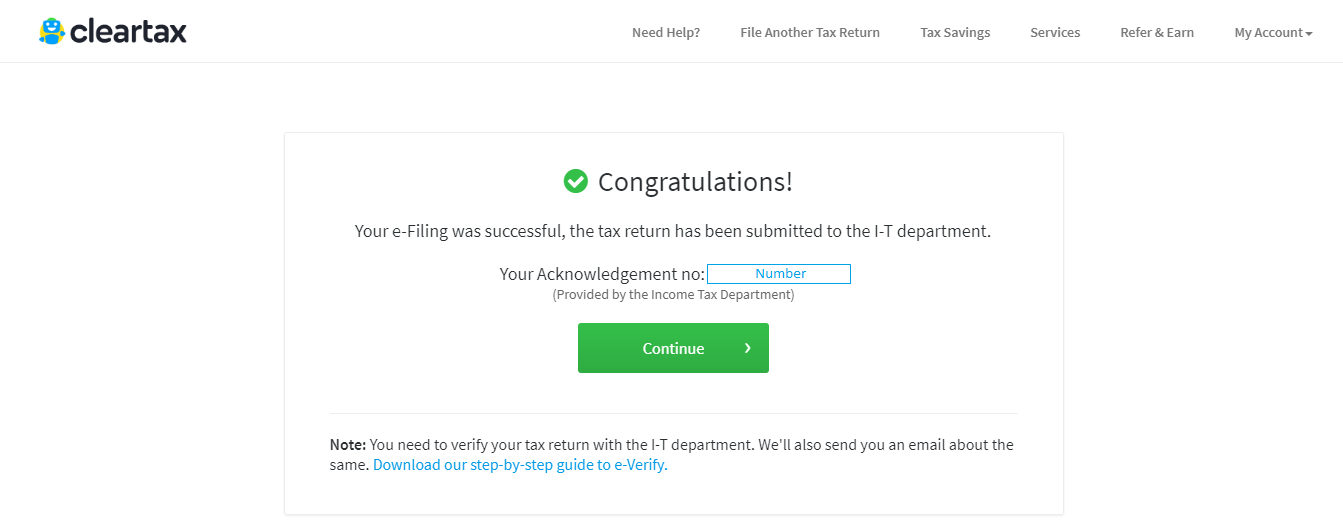

Then a page will appear to confirm the submission of the efiling. DO NOT REFRESH this page. At times, it takes up to five minutes to validate.

Step 13

After successful completion, you will receive an acknowledgement. In your mail, you will receive the ITR-V form.

How to verify your IT return online

Step 14

You need to eVerify your IT return within 120 days from eFiling.

Step 15

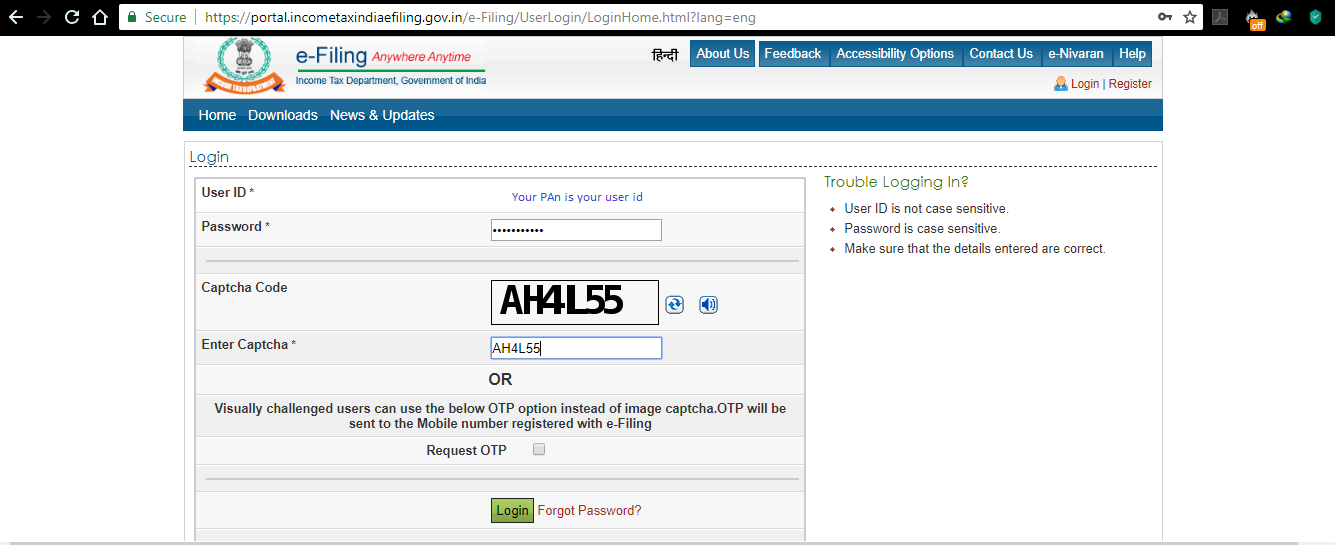

For eVerifying, login to https://portal.incometaxindiaefiling.gov.in/ and click on ‘eVerify return’ button under ’My Account’ segment. If you are doing this first time then you need to register.

Step 16

There you will find the list of It returns including both verified (previous financial years) and to be verified (for current financial year). The one to be verified (current financial year), should have a hyperlink ’e Verify’ at the right side of the row.

Click on the same and you will get options to through which you can e-verify like Adhaar OTP or Internet Banking.

Adhaar OTP -You will get e OTP in your mobile number which your registered with your adhaar card. You cannot select this option if you do not have mobile number registered with adhaar card.

Internet Banking – This option lets you verify with your bank’s internet banking portal. You need to have a internet baking activated and have you credentials ready to use this method.

After you verified with any one of the methods, a success message should appear conveying that the e verification has been completed successfully.

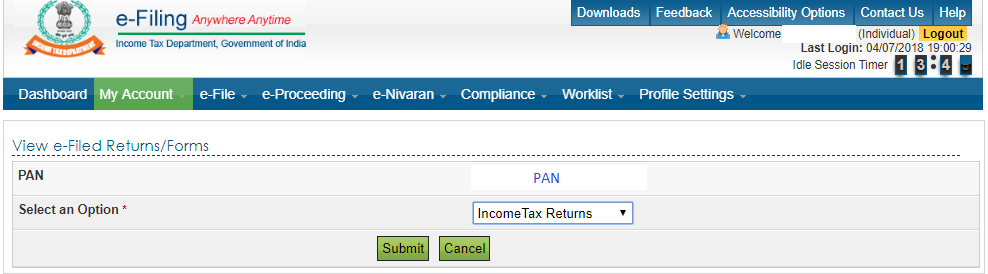

How to verify if IT return has been successfully filed

After successful completion of e verify, you can check the same in the government eVerifyportal in ‘View eFile returns/Forms’ under ‘My Account’ segment. Select the type as ‘IncomeTax Returns’ and click on ‘Submit’.

You will see the status as ‘Successfully e-Verified’ and after few days if ITR is properly done, the status will be updated as ‘ITR Processed.’