UPI (Unified Payment Interface) is a new technology using which we can make payment to any individual or any organisation at ease. What we just need is the registered phone number or the Virtual Payment Address (VPA) of the recipient.

The UPI service can be used from both smart as well as basic phones. For any mobiles including the basic ones, you can use the UPI system by dialling *99#. In this case you do not require internet connection in you phone.

If you are using a smartphone with active internet connection then you might also use the UPI applications available to enjoy the service.

Here we would be explaining the UPI application usage through smart phones first followed by usage of *99# USSD code.

Table of Contents

Security

Most of the people are afraid to register for UPI because they doubt the security. Since we can pay or receive money just by VPA or mobile number and does not require account number and IFSC code, people usually fear to trust. But it is totally safe, it is as secure as net banking.

Things required to get started

To register for UPI you need to download the UPI app in your mobile phone. There are many UPI apps in the market. The most popular being BHIM. Some other apps are as Phone Pe, Tezz, etc.

Remember you need to have a mobile number registered to your bank account to use UPI system. You also need to have the number active in the mobile where you have installed the UPI application

If you want to use UPI mobile application then your phone should be a smart phone with active internet connection for this !!

Using UPI mobile application in smartphones

Registering to UPI

- When you are all set, open the UPI application in your mobile and click on register. You need to select the number which is registered to your bank accounts. Then it would automatically send sms and detect the response and get registered.

- Now once the registration is done, you need to add the bank accounts to the application. You just need to click on the add bank account option and it would automatically detect all the bank accounts to which your mobile number is registered. You now need to select the bank account you need to link to the app.

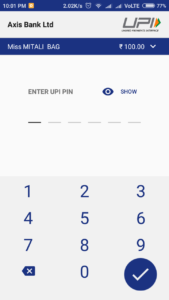

- Once you have added it is now time to set a UPI PIN for the account to make the transactions. To do this, click on reset upi pin or set upi pin option. This would again send an sms and redetect the response from the bank and would ask you to enter the PIN. Enter a PIN of your choice and reconfirm the same.

- Once you are done, you are all set to go.

Transaction using UPI

To make a payment to any person using the same UPI application

In this case you just need to save the phone number of the person to whom you want to send the money and remember it must be the number with which he/she has registered the application.

Now follow the below steps:

- Click on pay

- Select the recipient’s number from the list

- Enter the amount and click on pay

- Enter the PIN and click on submit. And you are done.

To make payment to a person using different UPI application

In this case you just need to know the VPA of the recipient.

Now follow the below steps:

- Click on pay using vpa

- Enter the vpa of the recipient

- Enter the amount and click on pay

- Enter the PIN and click on submit and you are done.

To make payment to any organisation

If you are doing a payment to any organisation such as IRCTC or LIC, etc, then follow the below steps:

- Choose the payment option as UPI

- Enter your VPA

- Click on submit

- Open the UPI application in you mobile

- You would get a notification in your application for the payment request.

- Click on pay

- Enter the UPI PIN

- Click on submit and wait.

- Once done, you would find the payment acknowledgement in the organisations portal.

To receive money from others

In this case if the sender is using the same UPI app just provide him your registered phone number.

If the sender is using other UPI application, then provide him/her your VPA. You would find your VPA in the UPI application of yours itself under the profile option.

UPI using USSD code, without smartphone or internet

Step 1: Dial *99# with your registered number and wait for 3-5 seconds.

Step 2: You will see all the options for its services. These options are-

- Send Money

- Request Money

- Check balance

- My profile

- Pending request

- Transactions

- UPI PIN

To select any option just type the option number and press the call button or click on Send button.

The details of each options are as below:

1. Send money

Use this service for sending money to anyone. Under this option you will see some more options on the screen as:

- Mobile number

- Payment address

- Saved beneficiary

- IFSC, Account No.

- MMID, Mobile No.

1- Send money using mobile number

- Enter beneficiary’s mobile number in the next screen and send again.

- Now, enter the amount and hit send button again.

- You will be asked to enter your UPI PIN to complete the transaction. Enter it and send.

- The money will be transferred and a success message will be shown on the next screen.

2- Send money using Payment address

- Enter beneficiary’s payment address in the next screen and send.

- Enter the amount and send again.

- Enter your UPI PIN in the next screen to complete the transaction.

- The money will be sent and a success message will be shown on the next screen.

3- Send money to saved beneficiary

- Choose from your saved beneficiaries by entering their serial number and send.

- Enter the amount

- Enter your UPI PIN

- Done

4- Send money using IFSC and Account No.

- Enter beneficiary’s IFSC in the next screen and send.

- Enter the account number of the beneficiary and send again.

- Enter your UPI PIN

- Done

5- Send money using MMID and mobile number

- Enter beneficiary’s mobile number

- Enter MMID of the beneficiary

- Enter your UPI PIN

2- Request Money

Just like BHIM app, you can request money using *99# banking also. Below are the steps to request money-

- Enter the mobile number or VPA of the person from who you are going to request money.

- Enter the amount to be requested and tap on send.

- Your request will be sent to that person and a success message will be shown.

3- Check balance

- Enter your UPI PIN and send again.

- Your account balance will be shown on the next screen.

4- My Profile

You can see and manage your profile details such as linked bank account, language etc. Enter 4 in the *99# banking menu and tap on send. You will see some options-

1- Change Bank Account

If you wish to change your bank account which is connected to the UPI, then select this option.

- Enter your bank name/first 4 letters of IFSC/Bank’s 3 letter short name/Bank’s 2-digit numeric code in the next menu and send again.

- A list of your accounts which are linked with your mobile number will be shown. Choose the account which you want to add by entering its serial number and send.

- Your account will be changed.

2- Change Language

You can change the language of the *99# banking menu. Currently, only English and Hindi are available.

- Enter 2 in My profile menu and tap on send.

- Now enter 1 for English or 2 for Hindi and send it again.

- Your language will be changed.

3- My Details

See your details such as name, primary payment address etc. using this option.

- Enter 3 in My Profile menu and tap on send to see your details.

- Your details including your name, payment address, linked bank account and UPI PIN condition will be shown on the next screen.

4- Payment address

You can see and manage your primary payment address using this option.

Follow below steps-

- Enter 4 in My Profile menu and send.

- Your primary payment address will be shown to you. You can also change your primary payment address by entering 1 here.

- A list of your payment addresses will be shown on the next screen. Choose the serial number of the desired payment address and hit send to make it your primary payment address.

5- Manage beneficiary

You can manage the beneficiaries using this option. You will see three options more under this as:

1- Add beneficiary

Add any beneficiary using his/her mobile number, IFSC+Account number or payment address.

2- Delete beneficiary

Delete any added beneficiary using this option. Choose from the list of added beneficiary. The beneficiary will be deleted.

3- View Beneficiaries.

Displays the list of the added beneficiaries.

5- Pending Requests

You can see all your pending requests using this option.

6- Transactions

You can see all the transactions done with *99# banking or BHIM app.

7- UPI PIN

You can set or reset or change your UPI PIN here. You will see two options. One for setting or resetting your UPI PIN and another for changing UPI PIN.

1- Set/Forget UPI PIN

- Enter last 6 digits and expiry date of your debit card separated by a space and send.

- Enter your new UPI PIN and tap send.

- Confirm your new UPI PIN and send. Your UPI PIN will be reset.

2- Change UPI PIN

- Enter your old UPI PIN and send again.

- Enter your new UPI PIN.

- Confirm your new UPI PIN. Your UPI PIN will be changed.

Charges and transaction limit for USSD Payment

The telecom service providers will charge to use NUUP services. The TRAI has set a maximum limit of ₹ 1.50/ transaction. However, you should contact your telecom service operator to confirm exact charges. The transactions limit for *99# banking is set to ₹ 5000 per transaction by Reserve Bank of India (RBI).

N.B.

The mobile banking service should be enabled in your account to access *99# services. If it is not enabled, visit your nearest branch to register your account for mobile banking.