Auto sweep facility in SBI (State Bank of India) can be activated online through internet banking as well as Yono SBI mobile application. The facility is named as Multi Option Deposit in SBI.

Want the know the steps to file ITR using the new 2.0 portal? See our blog post below:

How to File Income Tax Return for salaried individual using the new portal 2.0

Today in the blog, we are going to discuss the steps on how to activate auto sweep in SBI both by internet banking as well as mobile banking.

The minimum balance needed to activate auto sweep is Rs 35000.

If you want to know about auto sweep facility in details visit our blog post:

Table of Contents

Auto sweep facility in SBI using Internet Banking

Step 1:

Login to your internet banking account through https://retail.onlinesbi.com/retail/login.htm

Step 2:

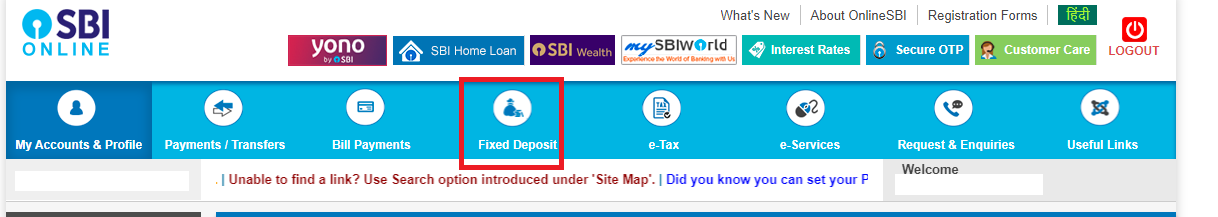

Go to the option Fixed Deposit in the menu.

Step 3:

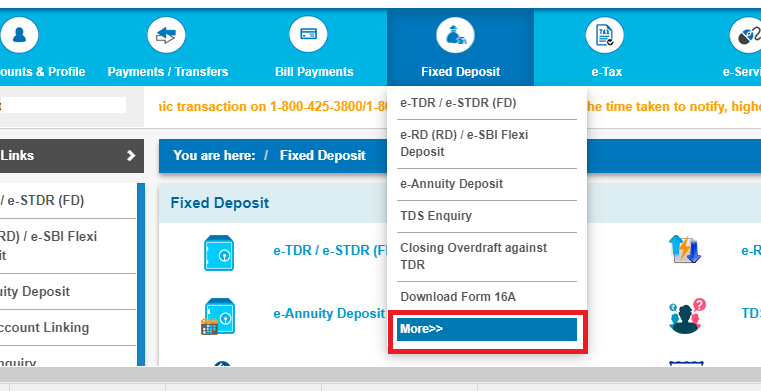

Select More at the bottom of the drop down list.

Step 4:

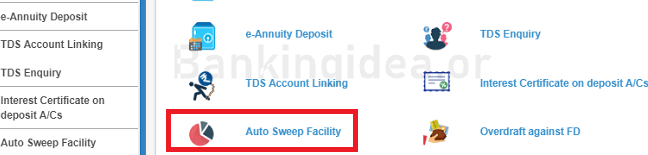

Now you can see a new page opens. Click on auto sweep facility.

Also read:

Step 5:

- Select the account which you want to activate the auto sweep facility on.

- Enter the threshold amount.

- Enter the duration of deposit.

If you want to know what you should put in these fields and how that matters, visit our blog post:

Auto sweep facility in savings account

If you are unable to find any account details to select, this means your account is not supported for auto sweep or you have it already activated in your account. Please contact the customer care or go to the branch to discuss on the issue.

Step 6:

Click on OK or submit.

Step 7:

Now you need to enter your transaction password and/or OTP. Once done your Multi Option Deposit (auto sweep) facility would be activated within few working days.

Also read:

How to Pay LIC premium using Phone Pe

How to submit form 15G/H in Axis Bank through Axis Bank mobile app

Activating auto sweep facility in SBI using Yono mobile application

If you do not have the application, here is the link to download it:

https://play.google.com/store/apps/details?id=com.sbi.SBIFreedomPlus&hl=en

Step 1:

Open the mobile application

Step 2:

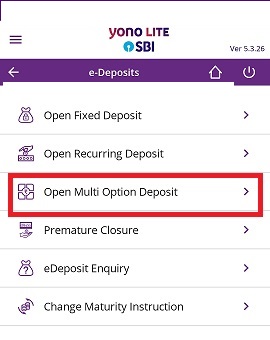

Click on e-fixed deposit option

Step 3:

Click on Multi Option Deposit

Step 4:

- Select the account which you want to activate the auto sweep facility on.

- Enter the threshold amount.

- Enter the duration of deposit.

If you want to know what you should put in these fields and how that matters, visit our blog post:

Auto sweep facility in savings account

If you are unable to find any account details to select, this means your account is not supported for auto sweep or you have it already activated in your account. Please contact the customer care or go to the branch to discuss on the issue.

Step 6:

Click on OK or submit.

Step 7:

Now you need to enter your transaction password and/or OTP. Once done your Multi Option Deposit (auto sweep) facility would be activated within few working days.

Also read:

How to transfer SBI account from one branch to another online

1) will auto debit work if i activate auto sweep facility in my sbi savings account??

2) suppose i withdraw 10000 rs from my savings account and threshold value i have kept is rs 25000, will that 10000 rs sweep out automatically from MOD account to maintain my 25000 rs threshold limit.

pls answer.

Hi Amit,

1) Yes auto debit will work even after activating auto sweep in SBI.

2) In SBI, amount from MOD account sweeps back to savings account only if the amount in savings account is less than the MINIMUM balance. Its tries to maintain the minimum balance, not the threshold amount. The threshold is the maximum limit of savings account, the amount above it will go to MOD.

In your case the answer is NO. 10000 rs will not go back to savings from MOD. If you withdraw more amount, and the balance in your savings account becomes less than 5000rs (suppose 5000rs is the minimum balance requirement of your account), then amount from MOD will go to savings and fill up to 5000rs to maintain the minimum balance.

Hope I could explain you. If not please feel free to ask in comment.

Please share this post if you find this helpful.

Hi, I am not able to see the above option when i click on Auto sweep.

below is the message i receive;

“There is no transactional account available with your username which can be converted into SB Plus.”

Also, is there a option of changing threshhold limits?

Hi Amit, you get this option when either you have already auto sweep activated in your account or your account is not eligible for auto sweep. As of what we have seen, there is no option to change the threshold limit online.

Very helpful article, aapki jaankari dusro se bahut achhi lagi

Hi,

Request you to please answer my query:

1. Let say I activated auto sweep by converting my saving account to saving plus account.

The start date I selected is let say (16.6.2020) and the threshold amt I choose is Rs.40000.

2. Meanwhile, I also opened another MOD account manually and deposited Rs. 80000. But I did this after 8.00 pm so it will get processed next day.

Now my question is, if (1) auto-sweep happen before (2) MOD account creation, then in that case I will not have sufficient balance in my saving for MOD…then what will happen in this scenario???

1. auto sweep normally does not occur the exact day you mentioned. That date your account would be converted so sbi plus. But auto sweep occurs on specific fixed days (once a month or once a week) according to the bank.

2. I am not sure what you meant by “opened another MOD account manually”. I think you want to say creation of FD manually? In that case I think its not possible to create FD online after working hours. Though I am not sure what happens in case of sbi.

is there any auto-sweep facility on NRE saving account?

Or any Indian bank offer any similar facility under maybe with different name.

thanks in advance.

regards,

your reader

I am not sure about NRE account. By saying similar facility by other Indian banks, if that is on normal savings account, then you can see this post

http://knowledgebear.com/auto-sweep-facility-in-savings-account/

I did not fill the data for MOD and logged out after getting the OTP. Now I am not able to change the data and also my account is also not showing when I click Auto Sweep. They have given no option to cancel. This is very bad design.

I am a new user and I was just checking out first what kind of things i have to fill. Now I have to go to the branch and get in line for 2 hours in this COVID time.

Huge bummer!!

But the information you shared here was very useful. Thanks Knowledgebear.

Thanks and yes, that is not good. You can wait for few days as see. May be reversal process taking some time and then you are able to see your account under auto sweep again.

You always have the option to go to branch if waiting does not work.

Hello Team,

How abt auto debit Loan amount… mY ques is think my balance is 1lakh and my EMI is 20k..will it auto deduct 20k from 1Lakh…??

If you have any auto debit thing along with autosweep, it would work normally without any problem, as long as you have the balance in your account (including mod balance).

Hello, I came across this page and was surprised by the ambience of candid knowledge and helpfulness displayed in it. Thanks.

May I know how I can generate a statement online like that in the pass-book which gives details of all transactions including sweep-ins, sweep-outs, clear balance and MOD balances? Thanks again!

Thanks for your comment.

You can generate a normal bank statement for your savings account online using net banking or mobile banking. There you will get transactions mentioning sweep in and sweep out and MOD balance.

Just open netbanking or mobile banking and select view/download statement under my accounts. Then select the date range and account number and click on view/download according to your need.

I will be creating a post soon with detail steps and images of the same soon. Hit subscribe to get notified as soon as we publish the same.

Hi

I have some questions for your kind attention please:

1) How can I include my SBI Equity Hybrid Fund Regular Growth in my SBI online banking page ? That page has only my Savings and PPF accounts.

2) How can I withdraw funds for emergency use from my above mutual fund ?

Thanks for your time.

I don’t think you can see mutual fund related information in banking website. There is a separate website for mutual funds of SBI. https://www.sbimf.com/en-us

hello!! I have SBI SGSP type salary account & when I select Auto Sweep it shows massage “There is no transactional account available with your username which can be converted into SB Plus.”

This means either your account is already having the auto sweep facility activated, or it is currently not eligible for the service. You need to contact the bank for help regarding this.

How to change threshold value in already activated autosweep account. For eg I gave threshold 50000 now want to change to 25000

I do not think that is possible over net-banking. To modify the amount you need to contact the bank directly.

Hi, I am getting the same issue. were you able to resolve this ? Thanks

There is no transactional account available with your username which can be converted into SB Plus. shows when i try to activate auto sweep pls suggest what to do

This means either your account is already having the auto sweep facility activated, or it is currently not eligible for the service. You need to contact the bank for help regarding this.

Sir, my name is Ajay Kumar i am Government employe, my sbi account is converted into pmsp account in 2017 and my auto sweep mod is continous workinng 1 year but last 2 year my mod is not working since 2018. I am used internet banking and I check auto sweep option ‘there is no transactional account available with your username which can be converted into auto sweep for corporate salary account’ I complaint many time in my sbi bank branch but no result, I lost interest in my money continously 2 year plz sir help what can I do.

This seems to be a problem that can only be solved by the bank. You just need to contact them. If they are not responding drop a mail to a higher official. You may get the contacts in SBI website.

I unable show total balance as it SBI saving plus account……. How can show the total balance in bank statement, or is it require to covert Saving plus account to Saving account. (to cancel auto sweep facility?)

I am not sure about cancellation of the auto sweep facility. Please contact your bank to know about this.

If i change my savings account to a salary account, will the auto sweep facility automatically be started ? And can I change my savings account to salary account online without going to the branch?

does auto sweep facility get started automatically if we change our account type from savings to salary account? And can we change savings account to the salary account online, without going to the branch?

I don’t think auto sweep will be auto started for salary account. Because, there are many person, who do not want auto sweep in their salary account. But you can always enable that online. Still to be sure, you can ask SBI customer care. And regarding the change of account type online, I am not sure about that. Contact the customer care or your branch.

I had applied for SB Plus account, but somehow they created and converted it to Corporate Salary Account – Silver.

Can auto sweep be activated in SBI Online through the ‘Sweep creation for CSA’ under ‘Requests & Enquiries’?

Is this the same to Auto Sweep Facility under ‘Fixed Deposit’?

Corporate Salary Account – Silver does have the auto sweep facility built in. I am not sure if its by default activated or you have to activate the same yourself. Seems like Sweep creation for CSA is same as auto sweep. But I would suggest to verify once from your bank before applying.

The monthly SBI credit card bill automatically debits from my SBI account(sweep debit to MOD account is active). Now this time I was maintaining sufficient fund, like always, in my SBI account but just one before the due date(credit card auto debit day), funds got shifted to the MOD balance. Now my concern is whether the bill will get paid as usual or will be any default on the credit card billing.

Thankyou

I believe bill will get paid as usual, and your money from MOD balance will get shifted to SB account accordingly. I would suggest to keep your eye on it, so that, if the auto debit fails, you can pay manually to avoid credit card interest.

while clicking for auto sweep facility through NB in my case it is showing “There is no transactional account available with your username which can be converted into SB Plus”

pl provide solution

In my case when im trying through netbanking it shows,”There is no transactional account available with your username which can be converted into SB Plus.”

What to do?

I was applying for auto sweep facility, but the session got expired after receiving the OTP and the account got converted into SB plus account. But I had not filled any info regarding the date, threshold or resultant balance.

Now under auto sweep, its showing that there is no transactional account present under my user name. What is the matter here ? how can the account get converted without submitting the req ? and if its converted why there is no mod present ?

This happens if the process gets interrupted in between. You now have the only option to do the same offline. Or it may be that it has taken the default values and activated MOD to your account. Default value I think is (1year duration of terms and threshold 25K).